ICG CASHFLOW RISK SCAN

A clear financial verdict before you make your next move.

A CFO-level assessment of your cashflow and financial risk — so you know exactly where you stand and what to do next.

Trusted by owner-led businesses across Australia

CFO-led assessments | CPA-qualified | Real commercial experience

WHY THE CASHFLOW RISK SCAN?

Most business owners rely on reports that show profit — not risk.

The Cashflow Risk Scan uncovers what standard financials often miss:

• Hidden cashflow pressure

• Timing gaps and future risk periods

• Margin and wage strain

• Structural weaknesses impacting growth

So you can make decisions with confidence — not guesswork.

HOW IT WORKS

Step 1 — Book & Upload

After booking, you’ll securely upload:

• Profit & Loss (last 12 months)

• Balance Sheet

• Cashflow statement (if available)

(Takes around 5 minutes)

Step 2 — CFO-Level Analysis

We review:

• Cashflow pressure points

• Timing and risk periods ahead

• Margin and cost structure

• Key financial drivers impacting cash

Step 3 — Your Results

Within 3–5 business days, you receive:

✔ A written Cashflow Risk Summary (PDF)

✔ A clear financial verdict

✔ Key cashflow drivers explained

✔ Practical next steps

✔ A focused 30-minute review call

WHAT YOU’LL GET

After your scan, you’ll receive:

✔ A Clear Financial Verdict

✔ Key Cashflow Drivers

✔ Practical Next Steps

Your result will be one of:

1 - Safe to Proceed

2 - Proceed with Caution

3 - High Financial Risk

WHO IT’S FOR

The Cashflow Risk Scan is ideal if:

• Cashflow feels tight or unpredictable

• You’re planning growth or major changes

• You want clarity before committing

• You need CFO-level insight without long engagements

WHAT’S INCLUDED

Your Cashflow Risk Scan includes:

• Review of key financial reports

• Cashflow pressure and timing analysis

• Risk period identification

• Margin and cost structure assessment

• CFO-level verdict and recommendations

• One focused review session

• Written summary of findings

No long-term contracts. Just clarity.

WHAT BUSINESS OWNERS SAY

⭐️⭐️⭐️⭐️⭐️

“Ross provides exceptional service. He is professional, reliable, and consistently goes above and beyond to support us. We’re extremely grateful for his guidance and highly recommend him — he is a valuable asset to any business.”

— Jess, Director, Harbourside Concrete Pumping

⭐️⭐️⭐️⭐️⭐️

“Ross helped our plumbing business gain clarity around charge-out rates, margins, and forecasting. His ongoing support and regular check-ins have made managing finances simple and controlled.”

— Matt, Director, Mid North Solutions Plumbing

WHY ICG?

The Cashflow Risk Scan is delivered by Ross Duguid — CPA-qualified, former CFO, and founder of Illuminate Consulting Group.

With 15+ years experience across commercial, public, and advisory environments, Ross provides real-world financial clarity — not generic advice.

Based in Australia. Working nationally.

THE PATH FORWARD

Step 1 — Cashflow Risk Scan

Every client starts here.

Step 2 — 90-Day Cashflow Reset (if risk is high)

Stabilise cashflow and fix pressure points.

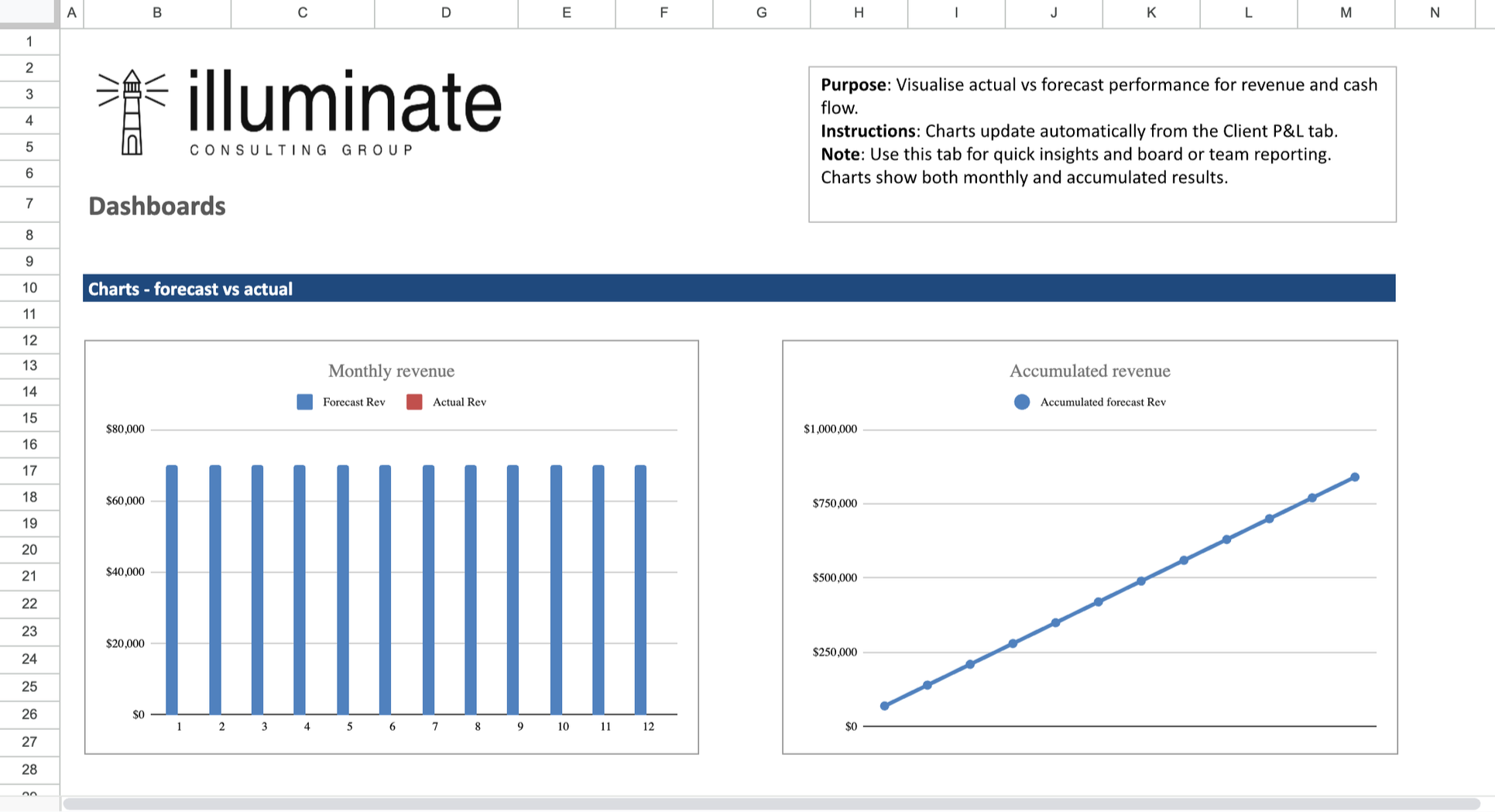

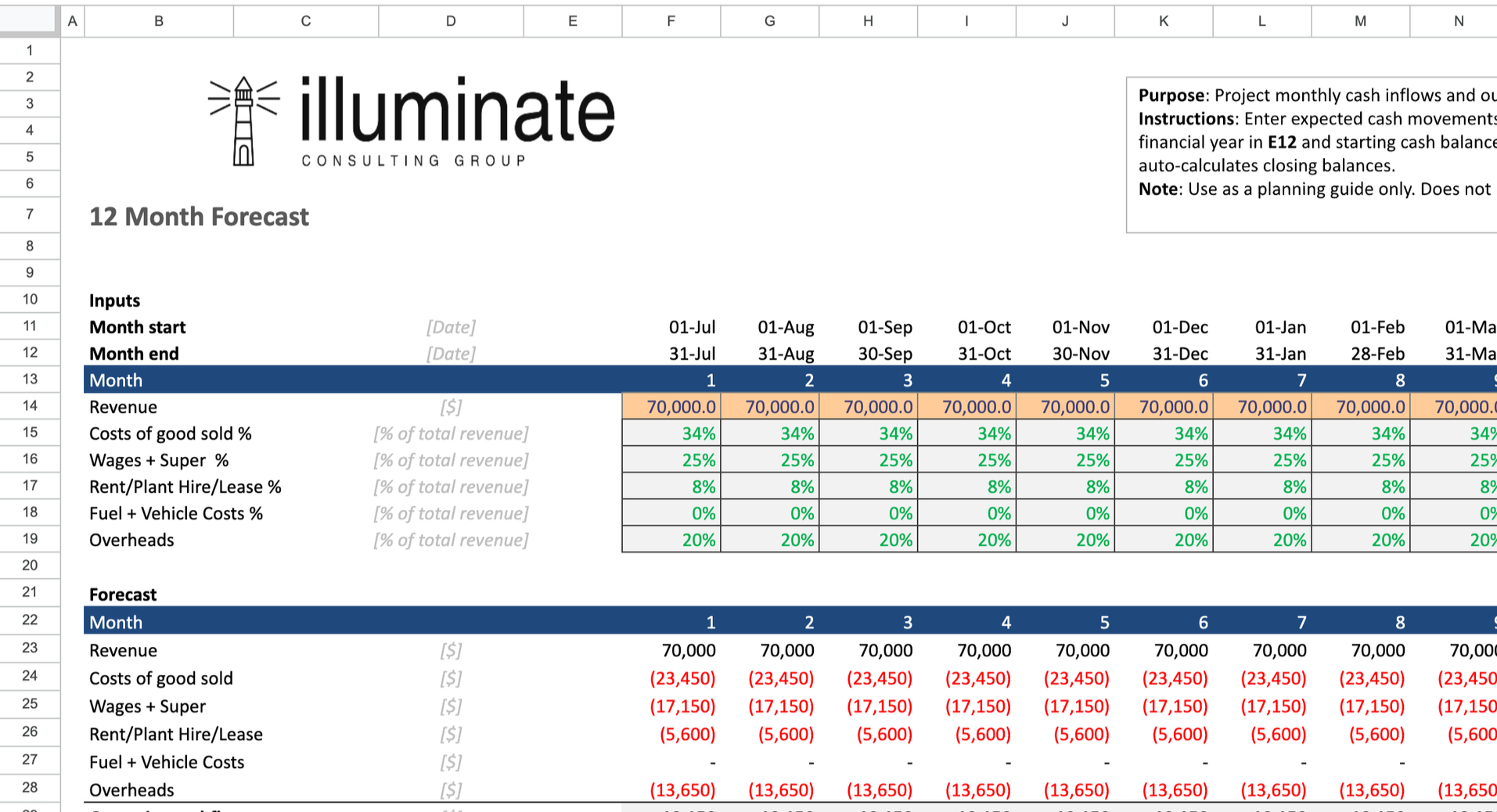

Step 3 — Cashflow Control Plan (12-month forecast)

Build a clear roadmap for growth.

Step 4 — Ongoing CFO Support (optional)

Strategic guidance as you scale.

FREQUENTLY ASKED Q’S

How long does the scan take?

Most scans are completed within 3–5 business days, followed by a 30-minute results call.

What do I need to provide?

Recent financial reports including Profit & Loss, Balance Sheet, and cashflow (details sent after booking).

What will I receive?

A written Cashflow Risk Summary plus a review call to walk through findings and next steps.

Is this a long-term commitment?

No — it’s a fixed-fee, one-off clarity engagement.